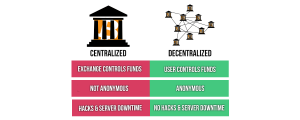

A decentralized exchange (DEX) is a marketplace for cryptocurrencies or blockchain investments that is totally open sourced. Nobody is in control at a DEX, instead buyers and sell deal with each other on a one-on-one basis via peer-peer (P25) trading applications.

A good way to think of a DEX is as a “do-it-yourself trading solution in the crypto universe.” One makes the trades and hold the funds or instruments in your own account. The biggest advantage to this system is that your funds will be not entrusted to a trading company or other third party.

A centralized exchange operates like a typical brokerage house, you deposit funds in an account and the exchange makes the trades for you. The advantage to this is that the exchange does all the work, and it is often insured and regulated by authorities.

Most of the large and well-known exchanges; such as GDAX (Coinbase) and CEX.IO are centralized. A popular benefit to these exchanges is that they will take credit or debit card and bank-transfer payments. They may also pay out in fiat currencies like dollars or Euros which many users prefer.

ADVANTAGES OF A DECENTRALIZED EXCHANGE

A lot of traders like DEXs because they have some serious advantages. Strangely enough, these advantages are why a lot of traders distrust decentralized exchanges.

Top advantages of a decentralized exchange can include:

- A DEX can be more resistant to hacking than a centralized exchange because account information is not shared with the exchange operator. Instead ,funds might be kept in your account and you will be the only person with access.

- Theoretically, governments or regulators cannot shut down a DEX because it is decentralized operating through a wide variety of nodes. Note: governments might be able to disrupt or wreck a DEX via malware.

- There is no server which can go down or get hacked. Instead, a DEX operates all over the cloud through a variety of nodes.

- There is a higher degree of privacy because you are not sharing your data with the exchange operator.

- You keep control of your funds in your own account.

- A decentralized exchange can be faster because you make the trades yourself.

DISADVANTAGES TO A DEX

Decentralized exchanges are not for everybody because they have some serious drawbacks.

Disadvantages to a DEX that everybody should be aware of include:

- There will be more work involved because you will have to handle chores normally taken care of by a centralized exchange such as making trades and transferring money.

- The funds are not regulated or insured. Regulated exchanges might be required to return the money at any time, so they keep funds in escrow for speedy withdrawals.

- Most DEXs will not take credit or debit card or bank-transfer payment.

- Trading volume is limited which can keep prices low and fees high.

- The services available from decentralized exchanges are limited. Margin trading, stop losses and trades involving fiat currencies will usually not be offered.

- There may be no customer service you can you can contact when there is a problem.

- A DEX can be much more expensive than a centralized exchange because you may need to purchase Ethereum Gas (Ethereum services) every time you make a trade. That means a decentralized trade can sometimes cost several times what a centralized trade would.

WHO SHOULD BE USING DECENTRALIZED EXCHANGES?

Decentralized exchanges are not for everybody. Many people including casual investors, cryptocurrency beginners, and persons that just want to make transactions in altcoins should stay away from them.

If you are not trading ICO tokens or buying large amounts of cryptocurrency there is little or no advantage to using a DEX. Likewise, people who are interested in margin trading, or currency trading would probably be better served by a centralized exchange like CEX.IO or Kraken. On the other hand, a person that needs to buy a large amount of cryptocurrency for a specific purpose might be better served with a DEX.

Anybody that uses a DEX should definitely have another method of cryptocurrency storage such as a hardware wallet or another digital wallet. Something to remember is that DEX is not based as a storage solution but as a trading mechanism.

Every investor needs to understand the difference between a DEX and a centralized exchange. Understanding how both solutions work can making trading easier and save you money.