Researchers from the University of Sydney, the University of Technology Sydney and the Stockholm School of Economics in Riga indicate that a quarter of all bitcoin users are associated with illegal activities.

The use of bitcoin for illegal purposes has been quite a controversial aspect of the crypto world, although it always remain hidden in plain sight due to major talks being about the price of bitcoin only.

Just like a share has it’s own intrinsic value, this fact that illegal activities done in bitcoin also account for the intrinsic value of Bitcoin.

Methodology

In the paper, which was co-authored by Sean Foley, Jonathon R. Karlsen and Tālis J. Putniņš,

Link:-https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3102645

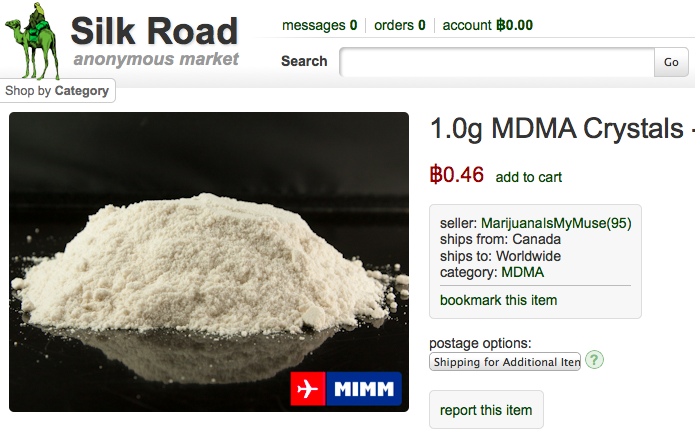

The publicly available information was used as the basis to identify an initial sample of users involved in illegal activity on the Bitcoin blockchain. Some wallets of darknet markets, and Bitcoin addresses on Darknet forums were used here, in addition to the trade networks of users who were identified in this data set.

Additionally, the researchers created their own algorithm to detect the users who are likely to be involved in illegal activity by measuring the entire public blockchain up until the end of April 2017.

The algorithm to detect criminals on the blockchain involves a wide variety of metrics such as transaction count, transaction size, frequency of transactions, number of counter parties, the number of dark-net markets active at the time, the extent the user goes to conceal their activity and the degree of interest in bitcoin in terms of Google searches at the time.

Bitcoin users that square measure concerned in criminal activity dissent from different users in many characteristics,” the paper says. “Differences in transactional characteristics square measure typically in step with the notion that whereas users preponderantly (or solely) use bitcoin as a payment system to facilitate change goods/services, some legal users treat bitcoin as AN investment or speculative quality. Specifically, most of the users tend to interact a lot of, however in smaller transactions. They do transactions in small quantities often,despite transacting a lot these users tend to carry less bitcoin, as they face risks of getting bitcoin holdings confiscated by authorities.

The paper also notes that bitcoin transactions between illegal users are three to four times denser, meaning those users are much more connected to each other through their transactions. This is consistent, the paper says, with illegal users taking advantage of bitcoin’s use as a medium of exchange, while legal users tend to view the cryptoasset as a store of value.

The Scale of Illegal Activity on the Bitcoin Network

As with any research into the activities of criminals on the internet, it’s important to take the findings of this study with a grain of salt. Remember, this is a study on the activities of those who do not wish their activities to be discovered in the first place.

On the other hand, there could be much lower criminal activity involved in Bitcoin then what has been written in the paper. Foley and other attribute this to two major reasons. One, the legal use of Bitcoin has grown as the interest has surged rendering the proportion of illegal use on a downward path. And, two, the rise of other cryptocurrencies which are more secretive. These cryptocurrencies have received comparatively greater attention from people involved in illegal activities lately.

Having said that, here are the levels of illegal activity on the Bitcoin network, according to the study:

- 24 million illicit users, which is 25 percent of all users

- 36 million illicit transactions per year, which is 44 percent of all transactions

- $72 billion worth of illicit transactions per year, which is 20 percent of the dollar-value of all transactions

- $8 billion in illicit bitcoin holdings at the time of the study

- 51 percent of all bitcoin holdings throughout bitcoin’s history have been illegal in nature

The study compares Bitcoin’s black market to the markets for illegal drugs in the United States and Europe. In the United States, this market is worth $100 billion per year. In Europe, the market is 24 billion euros on an annual basis.

More Takeaways from the Paper.

The paper notes that the illegal activity involving bitcoin is inversely correlated to the number of searches for “bitcoin” on Google.

“Furthermore, while the proportion of illegal bitcoin activity has declined, the absolute amount of such activities have risen with time, indicating that the declining proportion is due to rapid growth in legal bitcoin use,” says the paper.

The paper also indicates that privacy-focused altcoins, like Monero and Zcash, may be cutting into bitcoin’s role as the currency of the online black market.

The paper notes that it’s currently unclear if bitcoin is leading to an increase in black market activity or if this is simply offline activity moving onto the internet.

“What Paypal did to Ebay, Bitcoin is doing to the same thing to darknet marketplaces, By providing an anonymous, digital method of payment ” the paper adds.

According to the paper, this use case is the underlying value of the bitcoin asset.

“Our paper contributes to understanding the intrinsic value of bitcoin, highlighting that a significant component of its value as a payment system derives from its use in facilitating illegal trade.”

In addition to implications the online black market could have on the valuation of the bitcoin asset (a claim that is highly speculative as the bitcoin price has continued to see tremendous gains in the face of declining use for illicit payments), the paper adds that this realization also has ethical implications: those who choose to speculate on the bitcoin price may question whether they wish to provide liquidity for a payment system that enables illegal online transactions.